We partner with entrepreneurs at every stage—from early to mature—to raise capital that aligns with their growth trajectory. Whether for organic expansion or strategic acquisitions, we help identify the most suitable funding sources through our deep relationships with leading Indian and global investors.

Our long-standing network enables us to match founders with the right capital partners—ensuring strategic fit, smoother execution, and long-term alignment.

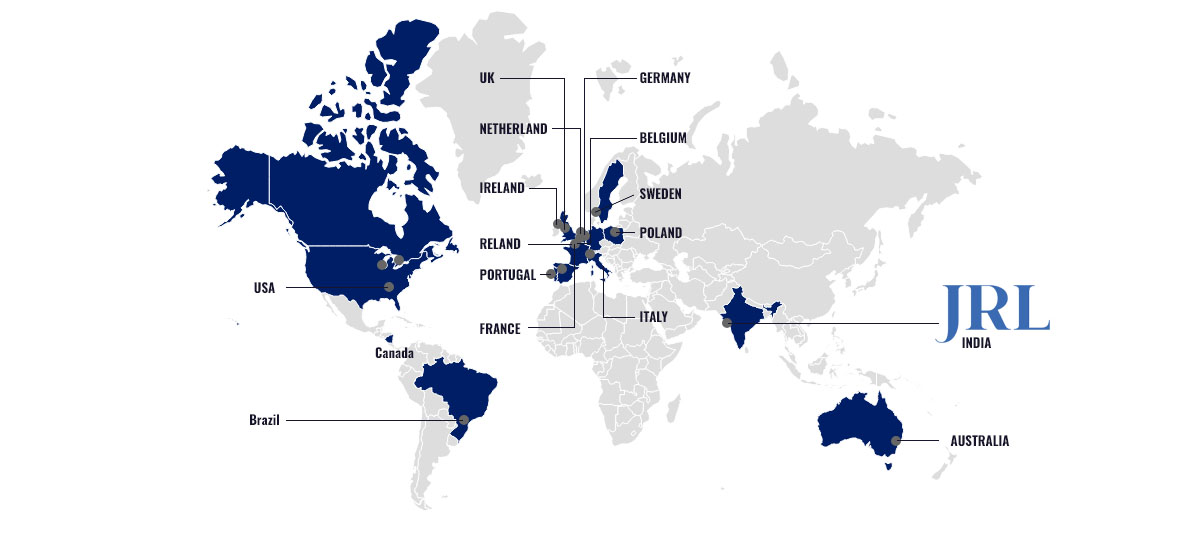

Global Reach Through the Pandea Network

JRL is the exclusive India member of Pandea Global M&A, a leading international network of independent advisory firms focused on mid-market transactions.

With a presence in 33 countries, 64 offices, and 250+ M&A professionals, Pandea gives us direct access to international investors, strategic buyers, and global opportunities—allowing our clients to think beyond borders.

The Pandea network Members have a combined a deal experience of having completed 2500+ transactions totaling over €30 Billion value disclosed across various segments such as

The membership allows JRL to leverage existing relationships with mid-market companies and conglomerates, offering them an alternative product in the form of mergers and acquisitions.

JRL also gets enhanced and cohesive access to a larger pool of international acquisition targets, local market expertise and overseas buyer pools.

Disclaimer : JRL is a member of the Pandea network. Each member of the Pandea network is an independent advisory firm which operates entirely independently of any other member; no member can create legal relationships on behalf of any other member. The Pandea network is not itself a separate legal entity in any jurisdiction. The Pandea network is administered by Dow Schofield Watts Corporate Finance Limited (“DSW”), a company registered in England and Wales (company number 07535311) whose registered office is at 7400 Daresbury Park, Daresbury, Warrington, WA4 4BS, UK. The Pandea brand and other intellectual property rights used by members of the network are owned by DSW

Just Deliveries

Private Equity

Santulan Ayurveda

Brand Valuation

Fruitbites

Strategic Investment

Pesca Fresh

Private Equity

Daily Objects

Private Equity

Good Dot

Private Equity

Creative Peripherals

Strategic Alliance

Pokerdangal

Private Equity

Future Group

Structured Finance

CapBuild

Private Equity

Inor Medical Products

Strategic Alliance

All That Dips

Private Equity

Sequretek

Private Equity

AgShift Inc.

Private Equity

Cryptzo Engineering

Strategic Alliance

GrabOnRent

Private Equity

BoxMySpace

Private Equity

Arman Financials

Structured Finance

SHASHI SUMEET PRODUCTIONS

Strategic Business Plan

Chhajed Foods

Private Equity

NAVA CHETANA FOUNDATION

Structured Finance

Kamineni

Strategic Tie Up

BIOMETRONIC

Private Equity

VASUDA GROUP

Strategic Tie Up

AM MOBILE

Strategic Tie Up

Kokuyo Riddhi Papers

Strategic Alliance

Ready to explore how JRL can support your financial goals?

Let’s start the conversation.

+91 22 6196 9000

infomumbai@jrladdha.in